AxiaFunder Housing Disrepair Investment Returns

HDR Investment Return and Volume

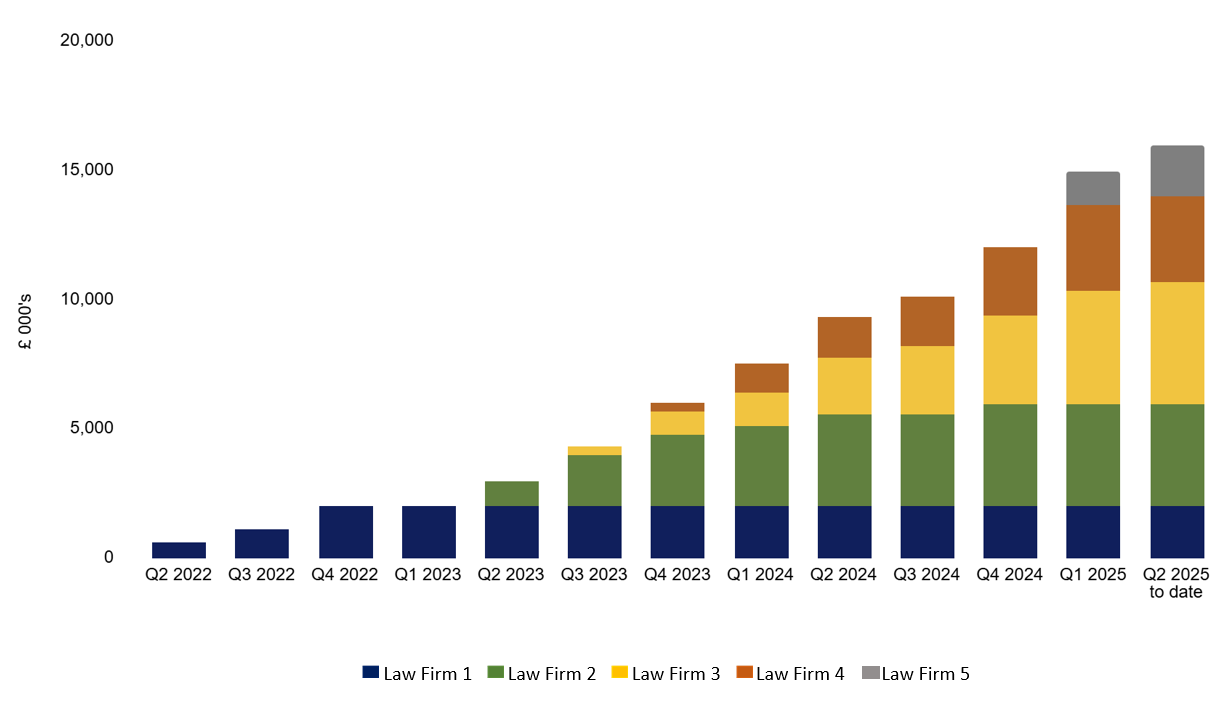

AxiaFunder has been funding UK Housing Disrepair (HDR) Litigation Claims since May 2022 - raising £15.97 million to date across 44 separate limited partnership Special Purpose Vehicles (SPVs), funding 5,928 claims. Within the housing disrepair portfolio — excluding Law Firm 1 — the IRR on paid-out tranches stands at 22.2%.

Figure 1: Housing Disrepair Cumulative Portfolio Funding by Law Firm (£’000s)

Source: AxiaFunder

Law Firm 1

The first funded law firm went into administration in July 2024. This law firm was funded via 7 SPVs. Investors recovered their invested capital only.

Law Firm 2

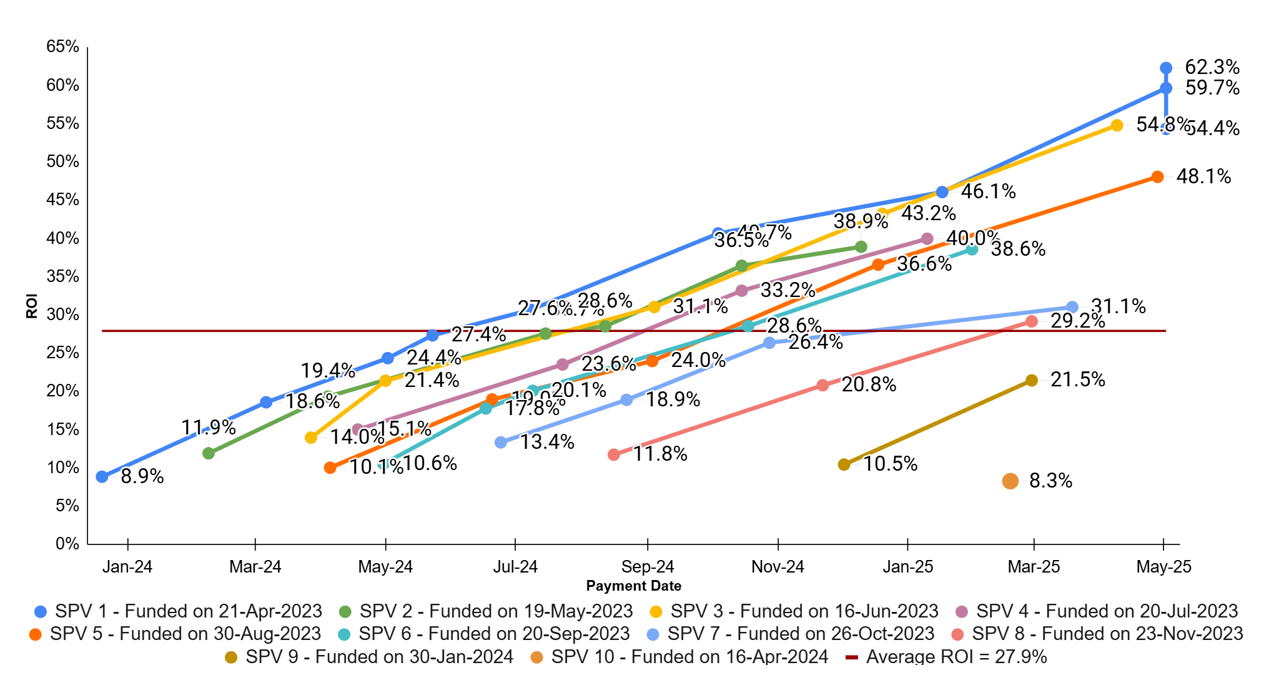

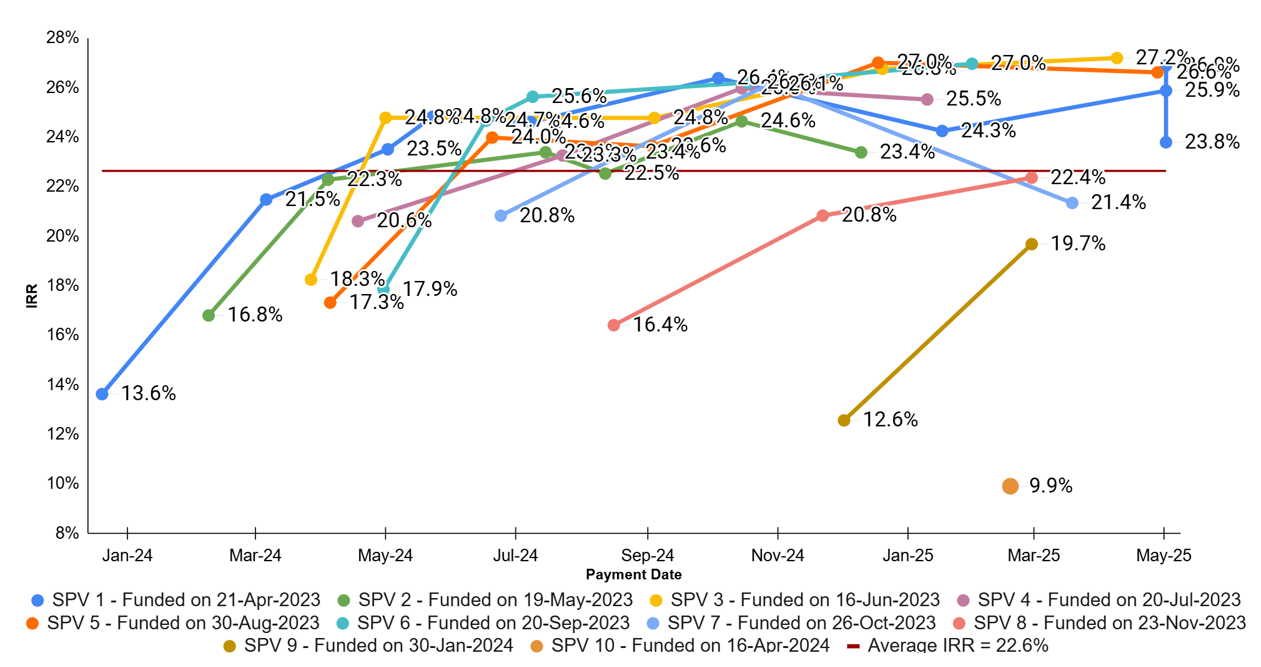

To date, 1,416 claims were funded via 11 SPVs. The net investor returns and IRRs for the first 10 SPVs are shown in Figures 2-3 below. The dots show the investor net gains (Figure 2) and IRRs (Figure 3) by tranche and time of the tranche payment. For example, looking at the resolved SPV1 funded in April 2023, the first 10%-tranche had a net investor gain of 8.9% (IRR of 13.6%) in December 2023, 8 months after the Offer launch, followed by returns of 18.6% (IRR of 21.5%), 24.4% (IRR of 23.5%), 27.4% (IRR of 24.8%), 30.7% (IRR of 24.6%), 40.7% (IRR of 26.4%), 46.1% (IRR of 24.3%), 59.7% (IRR of 25.9%), 54.4% (IRR of 23.8%) and 62.3% (IRR of 26.9%) from the subsequent tranches paid to investors between March 2024-May 2025. The average net investor gain for the resolved SPV1 is 37.3% (IRR of 23.5%).

In total, 45 10%-tranches have been repaid to date, together comprising 545 resolved claims (out of 1,265 claims funded by these 10 SPVs). The average net gain and annualised IRR to investors across the settled claims is 27.9% and 22.6%, respectively.

Contractually, claims that settle after a longer period tend to generate a higher return, e.g. the 10th tranche of SPV1 has generated returns of 62.3% (IRR of 26.9%).

Figure 2: Law Firm 2 Investor Net Return by Tranche

Figure 3: Law Firm 2 Investor IRR by Tranche

Law Firm 3

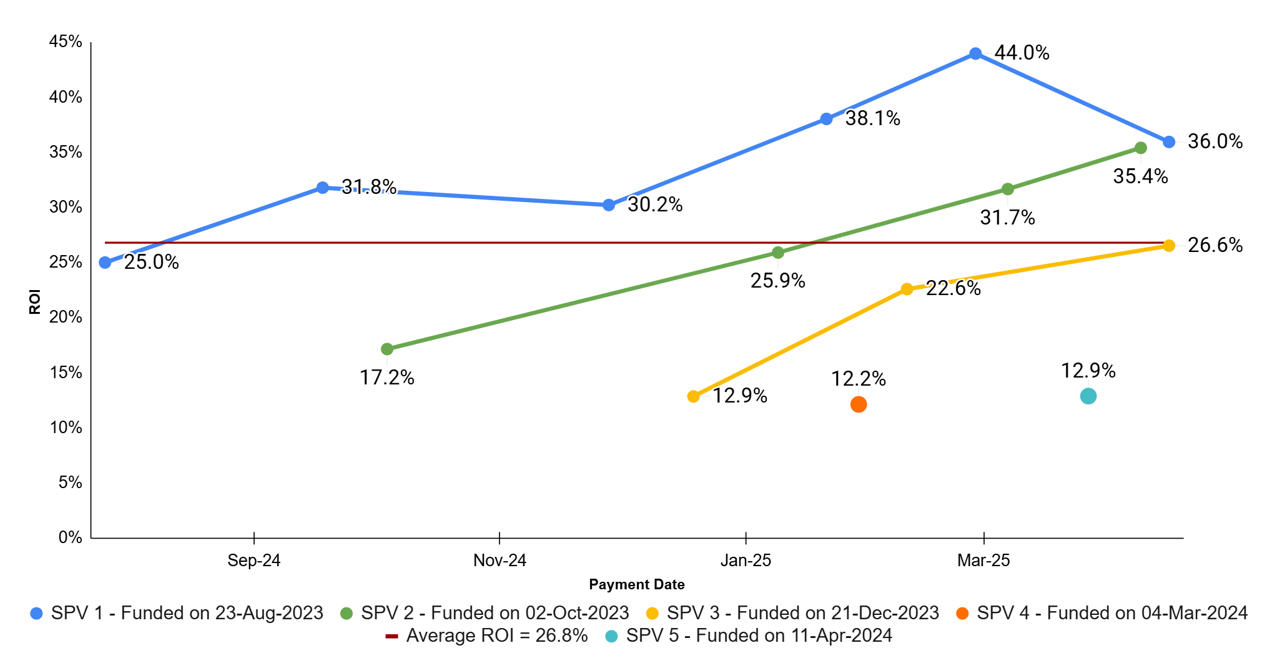

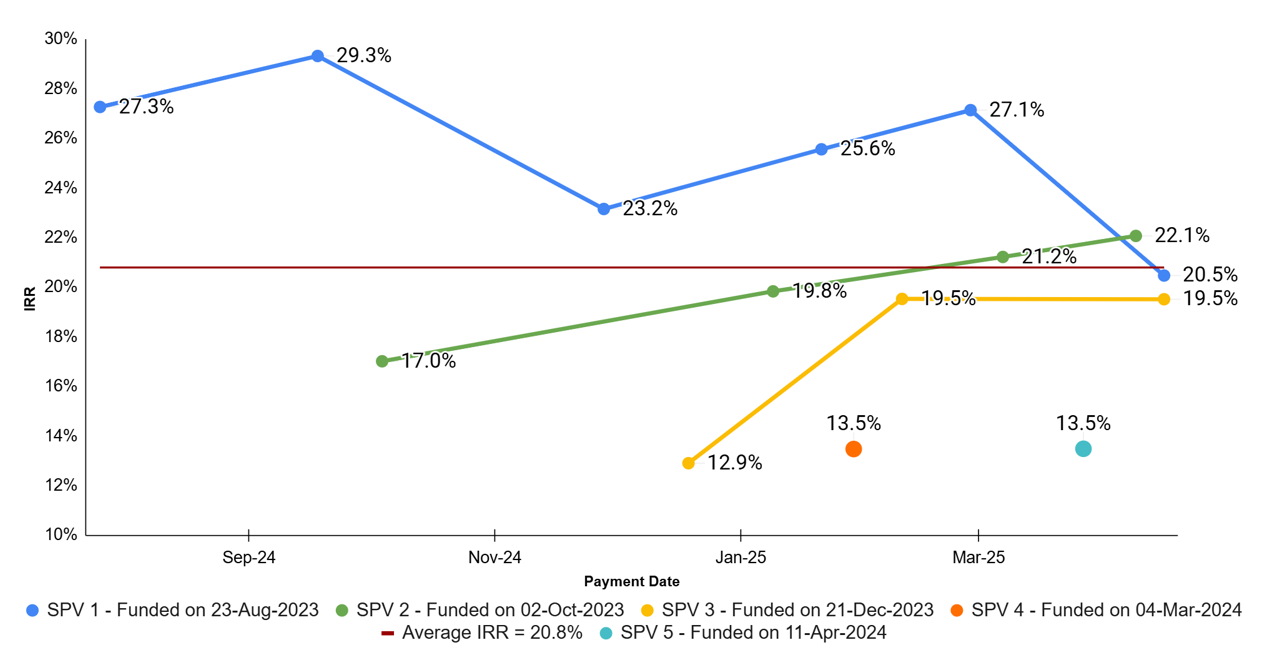

To date, 1,892 claims were funded via 12 SPVs. The net investor returns for the first 5 SPVs are shown in Figures 4-5 below. The dots show the investor net gains (Figure 4) and IRRs (Figure 5) by tranche and time of the tranche payment. For example, looking at SPV1 funded in August 2023, the first 10%-tranche had a net investor gain of 25.0% (IRR of 27.3%) in July 2024, 11 months after the Offer launch, followed by returns of 31.8% (IRR of 29.3%), 30.2% (IRR of 23.2%), 38.1% (IRR of 25.6%), 44.0% (IRR of 27.1%) and 36.0% (IRR of 20.5%) from the subsequent tranches paid to investors between September 2024-April 2025.

In total, 15 10%-tranches have been repaid to date, together comprising 198 resolved claims (out of 735 claims funded by these 5 SPVs). The average net gain and IRR to investors across the settled claims is 26.8% and 20.8%, respectively.

Contractually, SPV1 is entitled to receive a share of the law firm’s revenue on each claim regardless of the claim resolution timing. The other SPVs funding this law firm accrue the return daily.

Figure 4: Law Firm 3 Investor Net Return by Tranche

Figure 5: Law firm 3 Investor IRR by Tranche

Law Firm 4

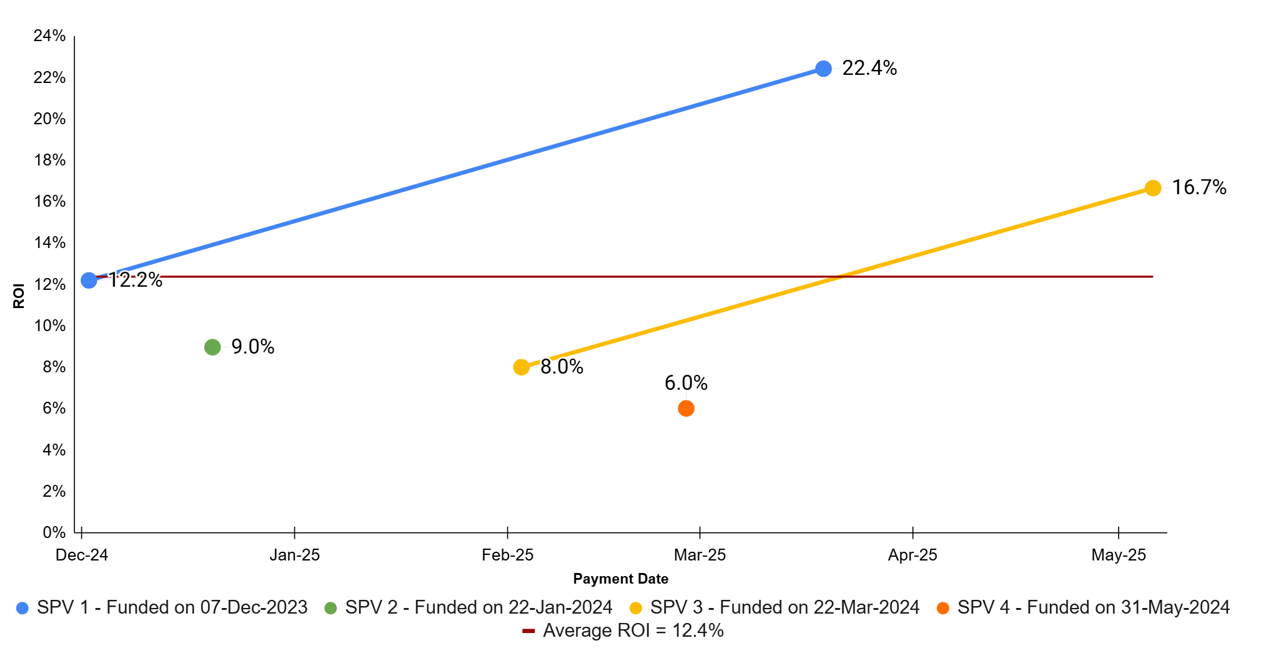

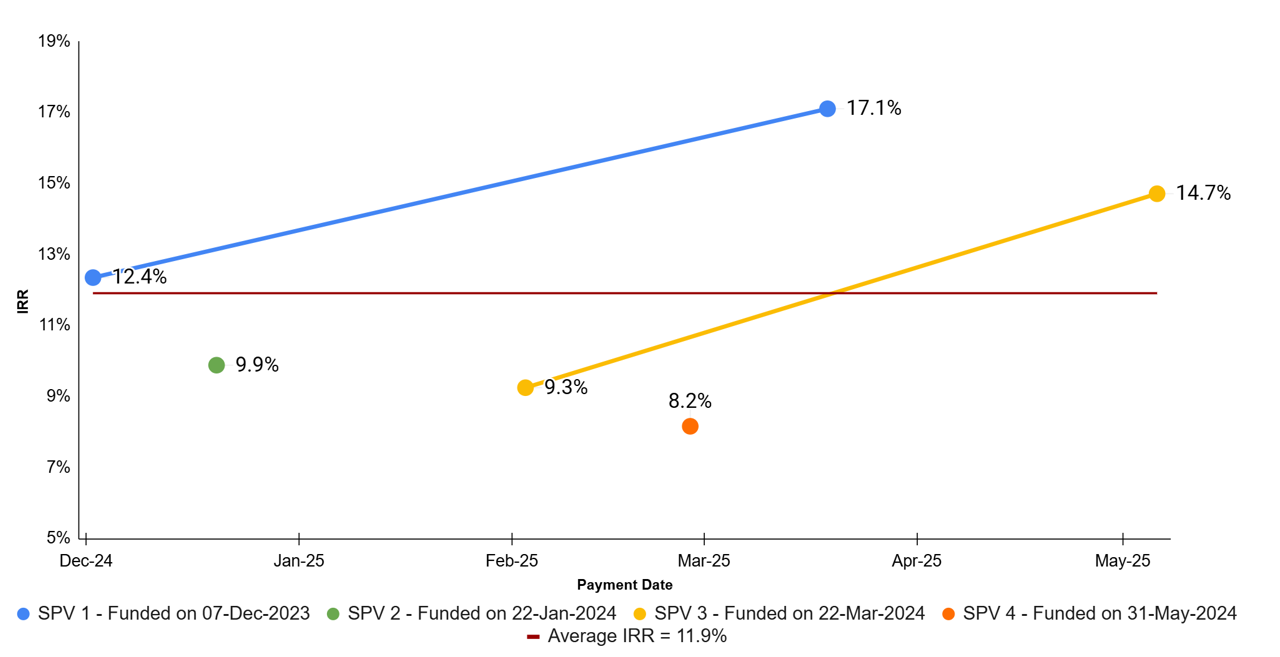

To date, 1,276 claims were funded via 9 SPVs. The net investor returns and IRRs for the first 4 SPVs are shown in Figures 6-7 below. The dot shows the investor net gain (Figure 6) and IRR (Figure 7) by tranche and time of the tranche payment. For example, looking at SPV1 funded in December 2023, the first 10%-tranche had a net investor gain of 12.2% (IRR of 12.4%) in December 2024, 12 months after the Offer launch, followed by a return of 22.4% (IRR of 17.1%) from the subsequent tranche paid to investors in March 2025.

In total, 6 10%-tranches have been repaid to date, together comprising 96 resolved claims (out of 650 claims funded by these 4 SPVs). The average net gain and IRR to investors across the settled claims is 12.4% and 11.9%, respectively.

Contractually, claims that settle after a longer period tend to generate a higher return, e.g. the 2nd tranche of SPV1 has generated returns of 22.4% (IRR of 17.1%).

Figure 6: Law Firm 4 Investor Net Return by Tranche

Figure 7: Law firm 4 Investor IRR by Tranche

Law Firm 5

To date, 740 claims were funded by 5 SPVs. There have been no repayments to investors yet.

AxiaFunder’s Notes

HDR claims are a mature and predictable claim type in our view. Any unsuccessful claims are contractually replaced by the law firm at no charge to the SPV which clearly improves investors’ returns. We closely monitor the individual claims and are in active dialogue with each law firm to make sure the claim portfolios are well-managed.

As shown above, SPVs typically only start to return cash to investors after approximately 6-12 months. From offer launch, we expect the SPVs to run for 12-24 months.

Source: AxiaFunder

To find out the latest case investment results, please visit Track Record page:

https://www.axiafunder.com/track-record

Disclaimer: Past performance is not a guarantee of future results and projected returns are not guaranteed to be realised. You should not invest unless you are willing to lose all the money you invest. This is a high-risk investment, and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.

- The Investor Appropriateness Test

- Risks for investors in litigation funding

- Understanding Your AxiaFunder Investment Portfolio

- AxiaFunder Portfolio Investment Returns

- Highly Commended Innovative Lenders Award

- New Podcast on the Legal Funding Journal

- 4th Way Review on Dieselgate Portfolio Investment

- AxiaFunder - actions taken to protect investors

- AxiaFunder Wins Innovative Lender of The Year Award

- AxiaFunder Housing Disrepair Investment Returns

- AxiaFunder FCA Direct Authorisation

- AxiaFunder won Innovative Lender of the Year Award

- Access to litigation investments

- The Peer2Peer Finance News Power 50 2022

- AxiaFunder Review by P2P Platforms

- AxiaFunder Review by 4thWay

- AxiaFunder interview with CEO Cormac Leech

- AxiaFunder Targets Double-Digit IRRs

- AxiaFunder Review in iTech Post

- AxiaFunder launched new litigation finance product