The high return investment opportunity - the best kept secret in investing?

The market of litigation funding

An investment class that has been around for nearly two decades and is already well known to sophisticated institutional investors such as investment banks and specialist hedge funds but until recently, has been off limits to even sophisticated retail investors. Litigation financing may now be the best kept secret in retail investing. While high net worth investors in the US have been able to participate in litigation funding for some time, the launch of AxiaFunder’s innovative platform marked the first time that retail investors in the UK have been able to gain access to this fast-growing and extremely attractive asset class in Europe.

The market in the UK continues to grow rapidly. It is estimated that the assets of the 15 biggest UK litigation funders reached over £2.2bn according to a report published by RPC in June 2022 - almost double from £1.3bn in 2017/18[1], but this is arguably still small when considering that the size of the total UK market for legal services is estimated at around £43.9bn pa[2]. Despite this impressive growth, there is plenty of anecdotal evidence that the UK market for smaller claims (<£1m in damages) remains severely underserved and of course largely closed to retail investors. This is perhaps not surprising given the preference of the institutional players to cherry pick the larger, more lucrative cases.

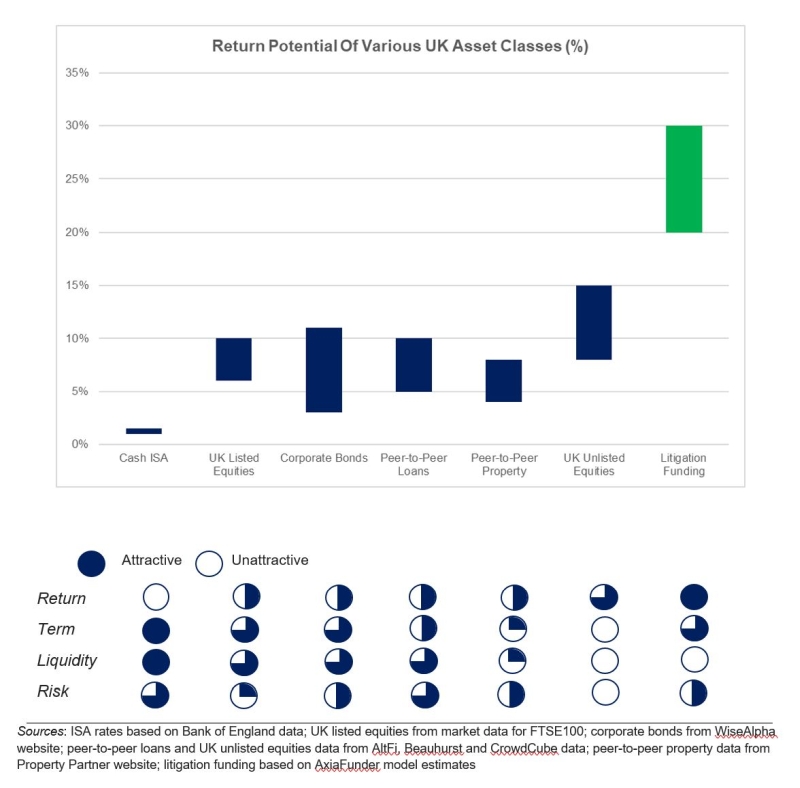

The return potential of litigation funding vs. other asset classes

The downsides of the high return litigation investment and solutions

- The investment risks

- Mitigating investment risks by diversification

We believe diversification can be especially effective in litigation funding because, although each case is high risk and binary in outcome, cases ARE uncorrelated with each other (which means that, mathematically, pooling cases leads to rapid reductions in the volatility of returns). This is markedly different to most commonly held investments, for example equities, which typically move in line with major indices and macroeconomic conditions. For investors this independence from other risk assets is a key attraction of third-party litigation funding.

- Improving the investment liquidity through secondary market

Litigation investments on the other hand tend to be of much shorter duration and always have a natural conclusion - either settlement or judgement. For typical commercial litigation claims this is around 2-3 years but could be much sooner if both sides are willing to sit down at the negotiating table. In fact, data from a listed litigation funder indicates that less than 10% of their commercial disputes end up going all the way to trial[4].

Furthermore, if you invest with AxiaFunder, you can trade your holdings in a case while the legal case is still ongoing through AxiaFunder’s secondary market on the platform, which is the first secondary market of this sort. To find out more, please visit secondary market (https://www.axiafunder.com/secondary-market).

How AxiaFunder select investments that have potential to generate high returns?

Like investment advisers and asset managers in other areas such as equities or fixed income, litigation funding companies, such as AxiaFunder add value through their ability to “pick the winners” – using their skills and experience to identify only the very best cases to fund while discarding those with limited prospects of success.

There are of course still residual risks that investors need to be aware of. In AxiaFunder’s case this means that aside from obviously only selecting those with clear legal merits, we also look at a number of key criteria. These include asking whether the case has : i) an independently verified probability of success of at least 70%; ii) attractive economics such as a minimum ratio of expected damages to costs of at least 5 to 1 and ideally closer to 10 to 1; and iii) a high likelihood of enforce-ability - in other words checking that the defendant has the means to pay the claimant should the case succeed.

Having experienced a significant broad-based rally in equity and property markets over the last 9 years, arguably now is a good time for eligible investors to look to diversify their exposure across other asset classes - ideally those with little or no correlation with traditional risk markets. In this regard, litigation funding seems like an attractive option although not without its own specific risks.

By Rabin Tambyraja, Professional Investor and AxiaFunder shareholder.

Updated Jan. 2024

[1] RPC litigation funding report, June 2022

[2] United Kingdom Legal Services Market Report 2023

[3] In a remote worst case scenario, an investor could lose double the amount they invest, e.g. if the insurance company providing insurance were to become insolvent.

- The Investor Appropriateness Test

- Risks for investors in litigation funding

- Understanding Your AxiaFunder Investment Portfolio

- AxiaFunder Portfolio Investment Returns

- Highly Commended Innovative Lenders Award

- New Podcast on the Legal Funding Journal

- 4th Way Review on Dieselgate Portfolio Investment

- AxiaFunder - actions taken to protect investors

- AxiaFunder Wins Innovative Lender of The Year Award

- AxiaFunder Housing Disrepair Investment Returns

- AxiaFunder FCA Direct Authorisation

- AxiaFunder won Innovative Lender of the Year Award

- Access to litigation investments

- The Peer2Peer Finance News Power 50 2022

- AxiaFunder Review by P2P Platforms

- AxiaFunder Review by 4thWay

- AxiaFunder interview with CEO Cormac Leech

- AxiaFunder Targets Double-Digit IRRs

- AxiaFunder Review in iTech Post

- AxiaFunder launched new litigation finance product